– Sigmastocks helps private individuals to invest in stocks, says Nanna Stranne, one of the three founders of Sigmastocks AB. Today, most private individuals choose to put their savings in funds, where management fees are way too high in proportion to what they offer. We asked ourselves whether people were really aware of this or not? It was then decided that we would create an alternative way to invest, where the money stayed with the investors rather than the bank’s pockets.

The super talents of the finance world

– The idea for Sigmastocks was conceived from Nanna and Mai Thai’s dissertation at Chalmers University of Technology in 2013, where they examined the problem concerning high fund management fees. They then got the ball rolling. The following year several actors became aware of their service, which had received awards and other accolades. Chalmers and Swedish angel investor Lena Apler, were two of the early investors that saw the value of the service. After offering the service for only a few years, Sigmastocks all ready had over three thousand customers. During this phase the team at Sigmastocks started expanding. In 2017, Nanna and Mai are crowned “Financial Profiles of the Year” in Gothenburg, and in 2018 they receive the award for “The Finance People’s Super Talents” by the Swedish financial magazine Veckans Affärer.

– Bringing home that title was fantastic, Nanna says. It is an honor to receive this much attention for what we are doing at Sigmastocks.

In the ripples of that award came a noble spot on the list of “Sweden’s 33 most innovative tech companies” in the tech and business magazines Ny Teknik and Affärsvärlden.

Take control over your investments

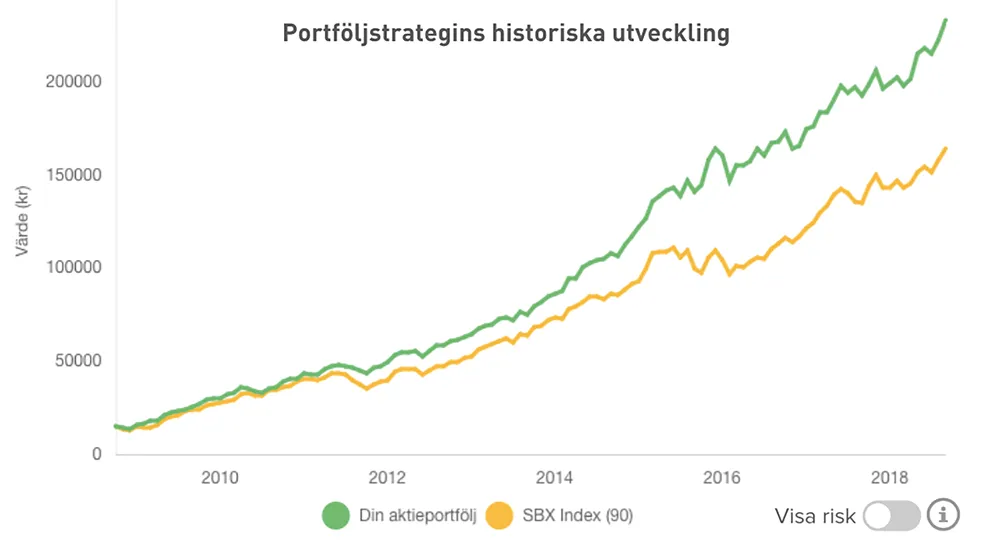

The average fund, for example the classic North American fund, charges their clients fees by claiming that they are actively managed, i.e. that they are making active choices on the stock exchange. In reality, these funds are passive, says Nanna. Additionally, it is not uncommon that they charge 1.5 percent in administrative fees, meaning the clients lose a large part of their revenue. In the long term, this amount can be shocking and is something that you as a client will not recover.

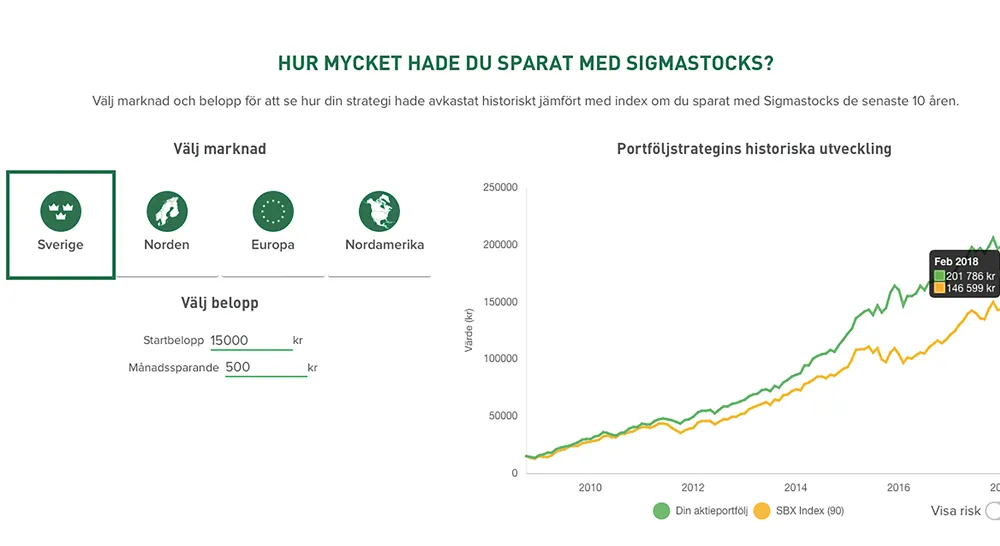

Sigmastocks wants to help you take control over your investments in a more personalized way in comparison to the big banks’ funds. Today’s digitalisation and lower brokerage prices offered are two convincing reasons to start investing on your own.

– In essence you can say that a fund is a middleman that exists between your money and the shares. This middleman has become unnecessary in today’s stock market. Our vision is to help as many people as possible to take the step to buy stocks instead of investing their money in average funds.

It being difficult is a myth

– Many people are afraid to invest in stocks. Sigmastocks has built an investment tool that gives you the support needed to be able to invest your money in stocks on your own.

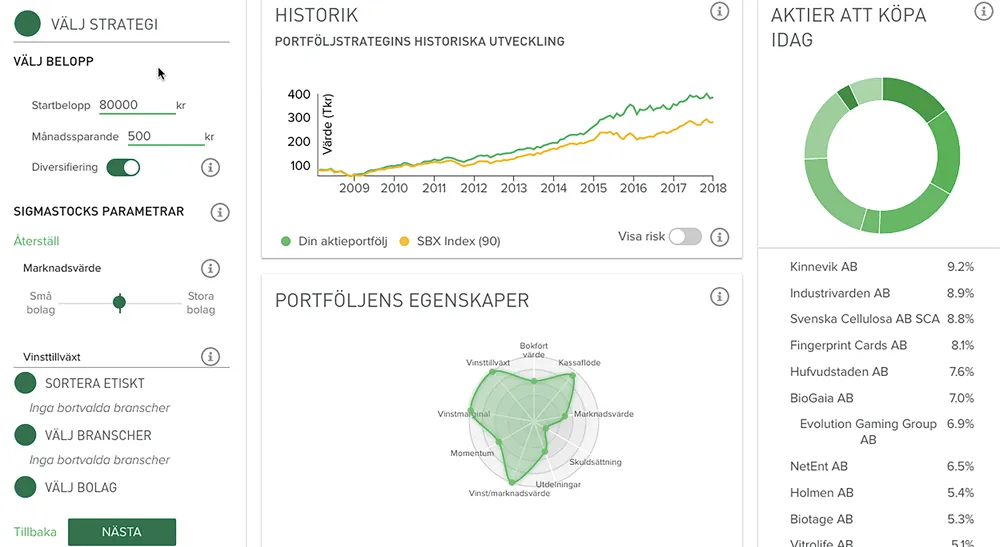

The journey begins by creating a strategy. You can choose to use one of Sigmastocks’ pre-set strategies developed by their team of experts, or customize your own strategy. You can save the strategy you have chosen, and then create an account. You can also choose how often you would like to investe: monthly, quarterly, or when you have some extra money you would like to save. For a small fixed monthly cost, Sigmastocks helps private investors to become their own portfolio manager. Sigmastocks directs you to purchase the stocks through their partners, or you can choose to make the purchases through your own bank.

– In the latter case you need to be aware of your bank’s brokerage fees, Nanna says. If you are new to stocks, we have a straightforward beginner’s guide that you can read through. It is important to take away the fear and the myth that investing in stocks is difficult or risky. You can define your own savings by using the sliders within the different parameters that we provide.

Through Sigmastocks you have the possibility to deselect companies and industries that for whatever reason do not appeal to you. It could be that you do not want to invest in the weapons industry or in fossil fuels. You choose your own strategy, and from that strategy the range of stocks is selected. You do not need any prior knowledge when it comes to investing in stocks. The investment tool offers pre-set strategies for those who wish to keep it simple.

The future for the financial profiles

Sigmastocks’ growth feels certain. Taking our service to other countries is appealing.

– We are doing something new in an old business, says Nanna. We challenge and put pressure on the prices for investing. The attention and awareness of what we are doing at Sigmastocks is much appreciated. We want to help as many people as possible to regain control over their investments and avoid the high fees associated with funds, making your money work for you. Today we are mainly helping private individuals, but companies are beginning to approach us for help. Things are moving quickly and it is exciting to see what the future holds.